FXSpotStream Celebrates 9 Years of Service

A Letter From The CEO

Dear Valued Clients, LPs and Vendor Partners,

Nine years ago, with the support of our founding banks, we set out to provide a more efficient, less expensive, more transparent way to allow our original six liquidity providing banks to interact directly with their clients and vice versa. One API in NY/LDN/TY, no fees for clients and a fixed fee for our LPs.

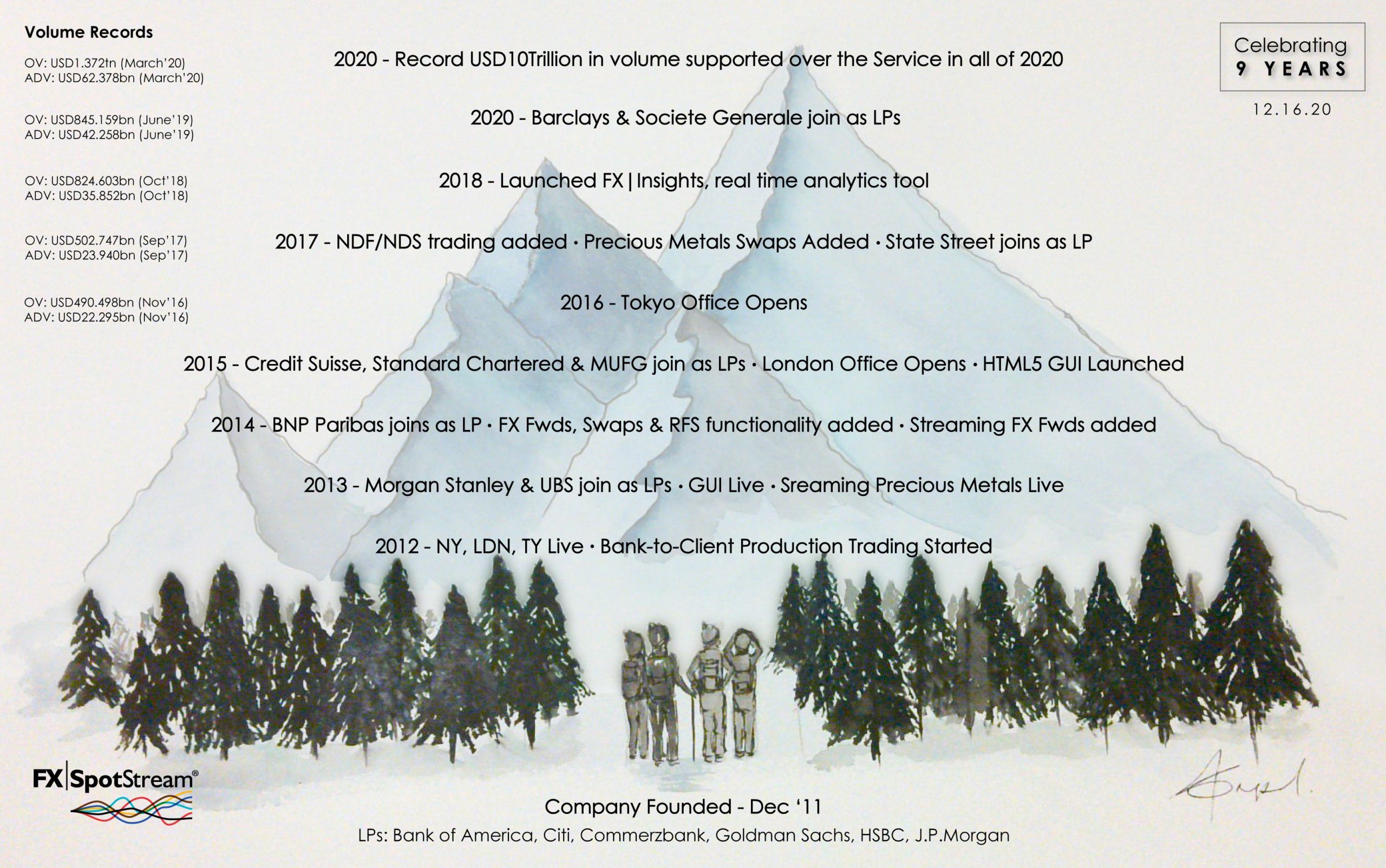

Fast forward to today and we are one of the fastest growing FX channels in the industry. Since our formation exactly 9 years ago we have added 9 more LPs, taking our total to 15, including: Bank of America, Barclays, BNP Paribas, Citi, Commerzbank, Credit Suisse, Goldman Sachs, HSBC, J.P. Morgan, Morgan Stanley, MUFG, Societe Generale, Standard Chartered, State Street and UBS. We have expanded the offering from a spot FX API to now include support for FX Spot, Swaps, Forwards, NDF/NDS and Precious Metals Spot and Swaps. We have added a GUI, a robust analytics tool – FX|Insights – and many order types and additional functionality. We have grown our client base around the world and now have staff in the US, the UK and Japan. And this year we broke another record crossing the USD10 Trillion mark in terms of volume supported on the Service – the most volume ever supported in any one year.

Despite our growth, I still view ourselves as a “start-up” and that’s how we run our business every day. We are about identifying an issue and finding solutions. Our team is about getting things done and moving the ball forward. And it’s because we have a great team that is aligned with the core principles of our company that we continue to grow every year.

In addition to working hard every day, I have always been keen to emphasize to the team the importance of customer support – ensuring that our clients, banks and vendor partners always hear from us when there’s an issue and that we address issues when they happen. We are a technology company and we will have issues from time to time. But the key is that we acknowledge when there’s an issue and we fix it. When a client has a need we address it. We have grown on all fronts in 9 years, but I am extremely proud of the fact that we have not forgotten our roots and we have maintained the top-level support that we are recognized for.

To those that have joined us along the way, we say thank you. Your loyalty and support have been instrumental in getting us to this point and will continue to drive us forward in the future. For those that we are yet to meet, we look forward to the opportunity to serve you and your business. Feel free to drop us a line at sales@fxspotstream.com if we can help.

Looking forward, we are very excited to have a large functionality announcement coming in Q1 next year that will see us continue to expand our offering to the FX market. Stay tuned!

Last, we take this opportunity to reflect on how fortunate we are to be able to continue doing what we do. It is a testament to our team that despite incredibly challenging times our business has continued to grow this year and we’ve had no interruptions to the Service. The FX market has seen its share of turbulence over the years and always comes out stronger. We are confident that the market and the many good people in the market will turn the corner in 2021. We won’t forget 2020, but we look forward to a return to a more normal world next year.

Best to all during the holiday season.

Warm regards,

![]()

Alan F. Schwarz,

Co-Founder, CEO FXSpotStream and the FXSpotStream Team

More Posts from FXSpotStream®

FXSpotStream September Volumes: All-Time ADV Record High

FXSpotStream registered a NEW RECORD ADV HIGH in September surpassing the ADV record set in March of this year. September’s ADV of USD73.351billion is a 20.45% increase MoM over August’s ADV of USD60.898billion and completes what has been the highest volume quarter in the company’s history. In Q3 2022, FXSpotStream supported USD4.359trillion, with a Q3…

The TRADE News Speaks with FXSpotStream CEO, Alan Schwarz, at TradeTech FX Europe

Reporting from TradeTech FX Europe: The TRADE speaks with FXSpotStream’s CEO, Alan F. Schwarz, about the importance of meeting client’s needs, volatility experienced this year, as well as what the future holds for the firm. Alan Schwarz, CEO of FXSpotStream from TRADE TV on Vimeo.

The FullFX Unfiltered with FXSpotStream

Following the addition of all the LP FX Algos to our GUI, our CEO, Alan F. Schwarz, and CTO, Tom San Pietro, sat down with Colin Lambert of The Full FX to discuss the growth in supported Algo volume on the API and GUI and what’s ahead. In August we registered an ADV high in…

Reflecting on 11 Years of Milestones

Eleven years after work began to create FXSpotStream, we reflect on some of the incredible milestones we have achieved along the way.

July Volumes: USD64.037 Billion; Second Highest ADV Ever

July overtook June as our second highest ADV ever, at USD64.037bn, an increase of 0.31% MoM. June had previously set a record for the second highest ADV, following a 9.32% increase over May 2022. July’s ADV represents a 33.66% growth in terms of ADV YoY for FXSpotStream, the largest YoY volume percentage increase of any…

June Volumes: USD63.878 Billion; Second Highest ADV Ever

FXSpotStream registered its second highest ADV ever in June ’22 surpassing the previous second highest ADV record set in February ’22. June also registered the 2nd highest total volume in any month. In addition, June’s ADV of USD63.837billion is a 9.32% increase over May’s ADV of USD58.392billion and marks a sixth consecutive month supporting well…

Featuring: Dan MacGregor (State Street), Ajay Kataria (Barclays), Loic Bourgeois Ducournau (Societe Generale) and Alan Schwarz (FXSpotStream) Understanding your market impact is a huge factor in any trade. Algos can be configured to your desired execution styles (passive, neutral or aggressive) and altered during execution. In our final episode we will discuss the WHY. When…

Featuring: Mark Meredith (Citi), Nickolas Congdon (Commerzbank), Evangelos Maniatopoulos (Credit Suisse) and Raju Dantuluri (FXSpotStream) In episode 3 we take a look at algo strategies with speakers from Citi, Commerzbank and Credit Suisse. Strategies are the big differentiator when choosing an algo and although some may appear similar on the surface, by controlling the parameters…

Algo Types: Accessing Spot Contingent Forwards and NDF Algos

Featuring: Paris Pennesi (HSBC), Alexander Nowak (J.P.Morgan), Asif Razaq (BNP) and Tom San Pietro (FXSpotStream) Understanding how the LPs deal with Spot contingent Forwards where clients can set a forward date on order entry and the Algo would automatically roll forward after it has executed. Popularity of NDF currencies with respect to deliverable currencies for…

FXSpotStream registered a NEW RECORD ADV HIGH in March ’22 surpassing the ADV record set last month. March’s ADV of USD70.115billion is an 11.06% increase over February’s ADV of USD63.135billion and completes what has been the highest volume quarter in the company’s history. In Q1 2022, FXSpotStream supported USD3.988trillion, with a Q1 ADV of USD62.313billion.…