Finance Magnates: FXSpotStream® raced ahead of CBOE FX in the final quarter of 2018, as top players cede market share

02/27/2019 – https://www.financemagnates.com/institutional-forex/execution/fxspotstream-cboe-and-lmax-exchange-gain-efx-market-share/ The composition of the market players offering electronic FX trading shifted somewhat over the past year. While traditional leaders in the face of Thomson Reuters and CME Group’s NEX acquisition kept things steady at the top, the company holding third spot changed in the latter part of 2018 as FXSpotStream® raced ahead of CBOE FX.

02/27/2019 – https://www.financemagnates.com/institutional-forex/execution/fxspotstream-cboe-and-lmax-exchange-gain-efx-market-share/ The composition of the market players offering electronic FX trading shifted somewhat over the past year. While traditional leaders in the face of Thomson Reuters and CME Group’s NEX acquisition kept things steady at the top, the company holding third spot changed in the latter part of 2018 as FXSpotStream® raced ahead of CBOE FX.

That said, over the past year the market share losers have been the biggest players in the eFX space. Both Thomson Reuters and CME Group’s NEX EBS division left more room for smaller companies.

Between 2017 and 2018, the dominance of the two biggest eFX trading volumes handlers which are reporting their numbers publicly declined by a touch over 5 percent. That said, Thomson Reuters and EBS are still holding close to two-thirds of eFX trading volumes as of 2018.

Over a year that was marked by low volatility, competition among market players has naturally increased. The trading venues have undertaken a number of initiatives to promote their services with FXSpotStream® adding State Street in February and highlighting its NDFs offering which it launched in 2017.

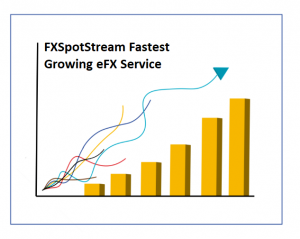

We touched upon the increasingly brisk volumes from the company in July last year, but towards the end of the year, that growth rate accelerated. FXSpotStream® raced ahead of CBOE FX in the final quarter of 2018 and kept its lead intact in January.

The annual growth rate for January reached over 46 percent, a figure which was also highlighted by a monthly increase of 18 percent when compared to December of 2018. The company shattered multiple records throughout last year and started 2019 with another one.

Asked about the reasons behind the growth of the company’s service, CEO Alan Schwarz pointed to FXSpotStream®’s unique business model; the vast expansion of the offering beyond spot, which also includes swaps, forwards, NDFs/NDS and precious metal spot and swaps; the high touch level of support provided; and the continued migration of volume from anonymous to disclosed channels. “FXSpotStream® is the only bank owned consortium that offers a completely free disclosed service to taking clients while liquidity providers don’t pay a per transaction fee to trade with their clients, but rather pay a fee unrelated to the amount of volume transacted,” Schwarz explained.

Higher Volumes in a Slow Market

Overall, last year the foreign exchange market has been relatively slow. The first quarter proved to be somewhat active, as the US dollar ceded ground across the board. Over the next nine months however, the greenback slowly recovered its losses and finished the year close to unchanged.

Institutional traders have gradually lost appetite in the market as political uncertainty dominated the space in Europe. In the meantime the lack of further escalation in trade wars prevented any material trends from emerging. That didn’t prevent the overall volume across eFX products from increasing by 17 percent across the publicly reporting venues that Finance Magnates tracked.

With all that said and done, 2019 started with a bang for the FX market. Unfortunately for most traders however, the flash crash spike from the first big trading day of the year didn’t lead to a sustained rise in volatility.

Market Share Developments

When looking at market share developments across the eFX spectrum we are taking two different approaches. We first compared January 2018 to January 2019, a statistic that singled out FXSpotStream® as the fastest growing eFX trading venue especially in the latter part of 2018 when it reported multiple records.

Overall for 2018, the firm’s market share increased by almost 2.5 percentage points to just above 10%. In the meantime despite losing third spot, CBOE FX also marked an increase by just below 2 percent at the cost of both Thomson Reuters and CME’s NEX EBS division, which lost 2 and 2.2 percent respectively.

Looking at January 2019, the market share developments year-on-year show Thomson Reuters dropping by less than 1 percentage point when compared to January 2018 to just above 33% of the total volumes. CME Group’s NEX EBS division marks a more pronounced drop from 33% to 29%. CBOE FX drops slightly by about 1 point to just below 13%.

he bulk of growth in market share falls on FXSpotStream® which managed to raise its trading volumes to as much as 13.3% of the total among publicly reporting eFX trading volumes. It inched ahead of CBOE FX marginally, and this race is likely to heat up in the coming months especially if the FX volatility cycle turns.

LMAX is another company that gained market share with a small bump to just below 5%. Euronext’s investment in Fastmatch lost out to competitors over 2018, but is looking to an upbeat start in 2019 with roughly 7% of the total trading volumes transacted via venues tracked by the Finance Magnates Intelligence department.

More Posts from FXSpotStream®

Barclays Joins FXSpotStream as the 14th Liquidity Provider

FXSPOTSTREAM ADDS BARCLAYS AS THE 14th LIQUIDITY PROVIDER AS FXSPOTSTREAM BUILDS ON A 21% YEAR ON YEAR VOLUME INCREASE IN 2019 TOPPING USD9.4 TRILLION February 25, 2020 – JERSEY CITY, N.J. – FXSpotStream LLC, a wholly owned subsidiary of LiquidityMatch LLC, today announced that Barclays has joined the Service as a liquidity providing bank to…

FXSpotStream is shortlisted in the TradingTech Insight Awards – Europe 2020 for Best Trading Solution for Foreign Exchange (FX) Markets

FXSpotStream is Once Again the Fastest Growing eFX Service

FXSpotStream continues to grow at the fastest rate of all eFX services in 2019 with a 22.55% ADV increase over 2018! 2019 ADV at USD36.530 billion Monthly ADV record in August of USD43,247 billion Intraday volume record of USD58,814 billion on August 1st Overall monthly record of USD951 billion in August

e-Forex Interview – The Market Shift from Anonymous to Disclosed Trading

FXSpotStream CEO, Alan Schwarz talks about the market shift from anonymous to disclosed trading with e-Forex. Click here to read the full article

FXSpotStream voted “Best Margin FX ECN/Multi-bank platform 2019” in J-Money poll for the 3rd year!

FXSpotStream is once again voted the winner of the 2019 “Best Margin FX ECN/Multi-bank platform” in the 28th Tokyo Foreign Exchange Market Survey by J-Money. This is the 3rd year in a row that FXSpotStream wins the award. Alan F. Schwarz, CEO, stated: “We are thrilled to once again be recognized by our Japanese clients…

FXSpotStream August Volumes: Record ADV, Daily Record and Overall Record

During August FXSpotStream’s ADV reached USD43.247 billion, the highest ADV ever on record for the Service and the third ADV record in 2019 (prior ADV high in June was USD42.258 billion). FXSpotStream’s ADV MoM (Aug ’19 vs Jul ’19) increased 19.23%. August’s ADV record of USD43.247 billion represents a YoY (Aug ’19 vs Aug ’18) increase of 52.46%. In…

During June FXSpotStream®’s ADV reached USD42.258 billion, the highest ADV ever on record for the Service and the second ADV record in 2019 (prior ADV high in January was USD38,367 billion). On June 20th FXSpotStream® recorded a new daily volume high of USD52.537 billion. In addition to an ADV record, in June – and despite…

FXSpotStream® has won the TradingTech Insight North America 2019 Awards for Best Exchange/Venue Market Access Gateway

eForex: FXSpotStream® Shatters Multiple Records

May 2019 – eForex speaks with Antony Brocksom about shattering multiple records and a strong start to 2019. Click on the link below to read the full article – https://e-forex.net/news/may-2019-fxspotstream-shatters-multiple-records-19.html

FXSpotStream® Shortlisted for FXWeek Awards

FXSpotStream® has been shortlisted by FXWeek for Best eFX Trading Venue of the Year in the 2019 FXWeek Awards!