FXSpotStream®‘s Expands with Addition of FX Forwards and Swaps

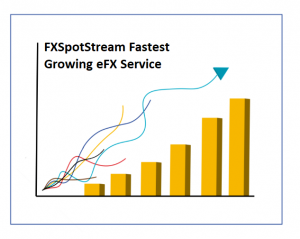

FXSPOTSTREAM®‘S PRICE AGGREGATION SERVICE EXPANDS WITH THE ADDITION OF FX FORWARDS AND SWAPS. AUGUST ADV SURPASSES PRIOR JUNE RECORD BY 28% AND GROWS 274% YEAR ON YEAR JERSEY CITY, N.J. – FXSpotStream® LLC, a wholly owned subsidiary of LiquidityMatch LLC, today announced the continued expansion of its Service with the addition of FX Forward and Swap price streams from its sites in New York, London and Tokyo. FXSpotStream®‘s liquidity providers, which include BofA Merrill Lynch, BNP Paribas Citi, Commerzbank AG, Goldman Sachs, HSBC, J.P. Morgan, Morgan Stanley and UBS, are now able to seamlessly stream Spot, Forward and FX Swap and Spot Precious Metals prices using the existing connection. Alan F. Schwarz, CEO, stated: “As we approach the 3 year anniversary of our business we are extremely pleased with the continued growth of the Service. The addition of FX Forwards and Swaps, together with RFS functionality, is a natural extension to the existing Spot FX and Precious Metals price streaming offering. At the same time, we have remained intently focused on supporting our liquidity providers and clients. As a result, we have seen the volume supported by the Service continue to increase at a rapid pace. August was yet another ADV record for FXSpotStream® exceeding the prior ADV record set in June by 28%. Year on year August ADV increased by 274% with August ADV surpassing ADV in July by 33% supported by an 88% year on year increase in clients in August. BNP Paribas is also now live globally and trading with clients. The utility model underlying the business and the alignment of our cost structure with the need by our liquidity providers and clients to reduce the significant fees incurred in transacting with each other is meeting its objectives. As we look ahead, we expect to continue to expand the offering with the addition of products, functionality and liquidity providers.” FXSpotStream® provides a multibank FX aggregation service to clients for the purpose of executing FX Spot, Forward and Swap and Spot Precious Metals trades. Banks connected to FXSpotStream® serve as liquidity providers to clients. FXSpotStream® functions as a market utility, providing the infrastructure that facilitates the GUI and multibank API routing mechanism to route trades from clients to liquidity providers. Clients access a GUI or single API from co-location sites in New York, London and Tokyo and have the potential to communicate with all liquidity providing banks connected to the FXSpotStream® solution. FXSpotStream® does not charge brokerage fees to clients or liquidity banks. Liam Hudson, BofA Merrill Lynch’s Managing Director and Global Head of FX Ecommerce Trading, said “BofA Merrill Lynch has been involved with FXSpotStream® from its inception and we continue to be impressed by how quickly the Service has grown with the addition of new liquidity providers, clients and functionality. Take up among our own clients has been extremely fast and we now have clients trading in all regions. The no brokerage fee model combined with a transparent and fully disclosed trading environment works well for us and our clients.” “We are delighted with the company’s growth, stability and reliability as it supports a growing number of liquidity providers and clients transacting more volume over the Service,” added Paul Scott, Global Head of eFX at Commerzbank Corporates & Markets. “The increased volume supported by the Service has exceeded our short term expectations. The addition of FX Forwards and Swaps to the existing product range will provide us and our clients with further opportunities to benefit from the Service.”

More Posts from FXSpotStream®

Barclays Joins FXSpotStream as the 14th Liquidity Provider

FXSPOTSTREAM ADDS BARCLAYS AS THE 14th LIQUIDITY PROVIDER AS FXSPOTSTREAM BUILDS ON A 21% YEAR ON YEAR VOLUME INCREASE IN 2019 TOPPING USD9.4 TRILLION February 25, 2020 – JERSEY CITY, N.J. – FXSpotStream LLC, a wholly owned subsidiary of LiquidityMatch LLC, today announced that Barclays has joined the Service as a liquidity providing bank to…

FXSpotStream is shortlisted in the TradingTech Insight Awards – Europe 2020 for Best Trading Solution for Foreign Exchange (FX) Markets

FXSpotStream is Once Again the Fastest Growing eFX Service

FXSpotStream continues to grow at the fastest rate of all eFX services in 2019 with a 22.55% ADV increase over 2018! 2019 ADV at USD36.530 billion Monthly ADV record in August of USD43,247 billion Intraday volume record of USD58,814 billion on August 1st Overall monthly record of USD951 billion in August

e-Forex Interview – The Market Shift from Anonymous to Disclosed Trading

FXSpotStream CEO, Alan Schwarz talks about the market shift from anonymous to disclosed trading with e-Forex. Click here to read the full article

FXSpotStream voted “Best Margin FX ECN/Multi-bank platform 2019” in J-Money poll for the 3rd year!

FXSpotStream is once again voted the winner of the 2019 “Best Margin FX ECN/Multi-bank platform” in the 28th Tokyo Foreign Exchange Market Survey by J-Money. This is the 3rd year in a row that FXSpotStream wins the award. Alan F. Schwarz, CEO, stated: “We are thrilled to once again be recognized by our Japanese clients…

FXSpotStream August Volumes: Record ADV, Daily Record and Overall Record

During August FXSpotStream’s ADV reached USD43.247 billion, the highest ADV ever on record for the Service and the third ADV record in 2019 (prior ADV high in June was USD42.258 billion). FXSpotStream’s ADV MoM (Aug ’19 vs Jul ’19) increased 19.23%. August’s ADV record of USD43.247 billion represents a YoY (Aug ’19 vs Aug ’18) increase of 52.46%. In…

During June FXSpotStream®’s ADV reached USD42.258 billion, the highest ADV ever on record for the Service and the second ADV record in 2019 (prior ADV high in January was USD38,367 billion). On June 20th FXSpotStream® recorded a new daily volume high of USD52.537 billion. In addition to an ADV record, in June – and despite…

FXSpotStream® has won the TradingTech Insight North America 2019 Awards for Best Exchange/Venue Market Access Gateway

eForex: FXSpotStream® Shatters Multiple Records

May 2019 – eForex speaks with Antony Brocksom about shattering multiple records and a strong start to 2019. Click on the link below to read the full article – https://e-forex.net/news/may-2019-fxspotstream-shatters-multiple-records-19.html

FXSpotStream® Shortlisted for FXWeek Awards

FXSpotStream® has been shortlisted by FXWeek for Best eFX Trading Venue of the Year in the 2019 FXWeek Awards!